Blog

Explore our collection of articles covering thought leadership, engineering, blockchain trends, how to integrate with Blockradar API and more.

Explore our collection of articles covering thought leadership, engineering, blockchain trends, how to integrate with Blockradar API and more.

If you’ve ever sent tokens to the correct address but on the wrong blockchain, you know that gut-drop moment when it feels like your funds have vanished Most wallets and exchanges will tell you those assets are unrecoverable With Blockradar Asset Recovery, getting your tokens back is possible and simpler than you might think.

It’s now time to move to the “advanced” section where you can unlock the full potential of onchain finance. You might ask yourself, “what if I want to interact with a protocol, my own token, or onchain service that’s unique to my business?”

Last week, Mexico City hosted the first ever Stablecoin Conference by Bitso, bringing together over a thousand attendees from across the world. The event was a unique mix: large enough to attract the major players across payments, infrastructure, and DeFi, yet intimate enough that real, candid conversations could happen in the hallways, over coffee, and between sessions.

La semana pasada, Ciudad de México fue el escenario de la primera Stablecoin Conferencia organizada por Bitso, un encuentro que reunió a más de mil participantes de todo el mundo. El ambiente fue especial: lo suficientemente grande como para atraer a los principales referentes de pagos, infraestructura y DeFi, pero también lo bastante cercano como para sostener conversaciones francas y valiosas en los pasillos, con un café en mano o entre ponencias.

In the previous guide, we walked through accepting crypto payments and integrating AML checks into your app using our wallets and webhooks. Now, let’s take it one step further by enabling you and your users to swap or bridge assets directly from the Blockradar wallet.

Gateway has arrived on mainnet, a new product designed to solve one of the biggest headaches in stablecoin operations: wallet and chain fragmentation.

The U.S.'s GENIUS Act and the SEC’s Project Crypto is a shift that legitimizes what many of us have already been building. And it could finally unlock broader adoption, partnerships, and compliance-ready integrations at scale.

Once your app accepts stablecoin deposits, the next step is protecting your platform from risk. With Blockradar, every incoming deposit or withdrawal wallet address can be automatically screened for compliance using our built-in AML engine.

This hands-on guide shows you how to integrate stablecoin payment collection using Blockradar, from account setup to wallet creation and real-time deposit tracking. Blockradar makes it easy for fintechs to launch secure, non-custodial stablecoin products without needing deep blockchain knowledge. One API unlocks wallet management, cross-chain payments, gasless transactions, smart payment links, auto-sweeps, and more. Whether you're building for payouts, treasury, savings, or user wallets — this is your fastest path to go live.

Blockradar has been selected for not just one, but two global startup showcases next week and we can’t wait to show up. We’re heading to Switzerland and London to share what we’ve been building and why it matters.

Stablecoins have started to win remittances and cross-border payments, but now they need to win the boardroom. Startups use them. Freelancers rely on them. But the world’s largest corporations are still watching from the sidelines. Why?

Designing crypto products in emerging markets taught me one thing: if users don’t trust it, they won’t touch it. Web3 keeps shipping for developers and not people with confusing flows, technical jargon and zero safety nets. Until using a dApp (decentralized applications) feels as seamless as M-Pesa or Revolut, we’re not onboarding the next billion users onchain. We’re just impressing ourselves. This post is a call for human-centered design: a look at how blockchain UX became one of the biggest barriers to adoption and why the next billion users will only come when we start designing for people and not systems.

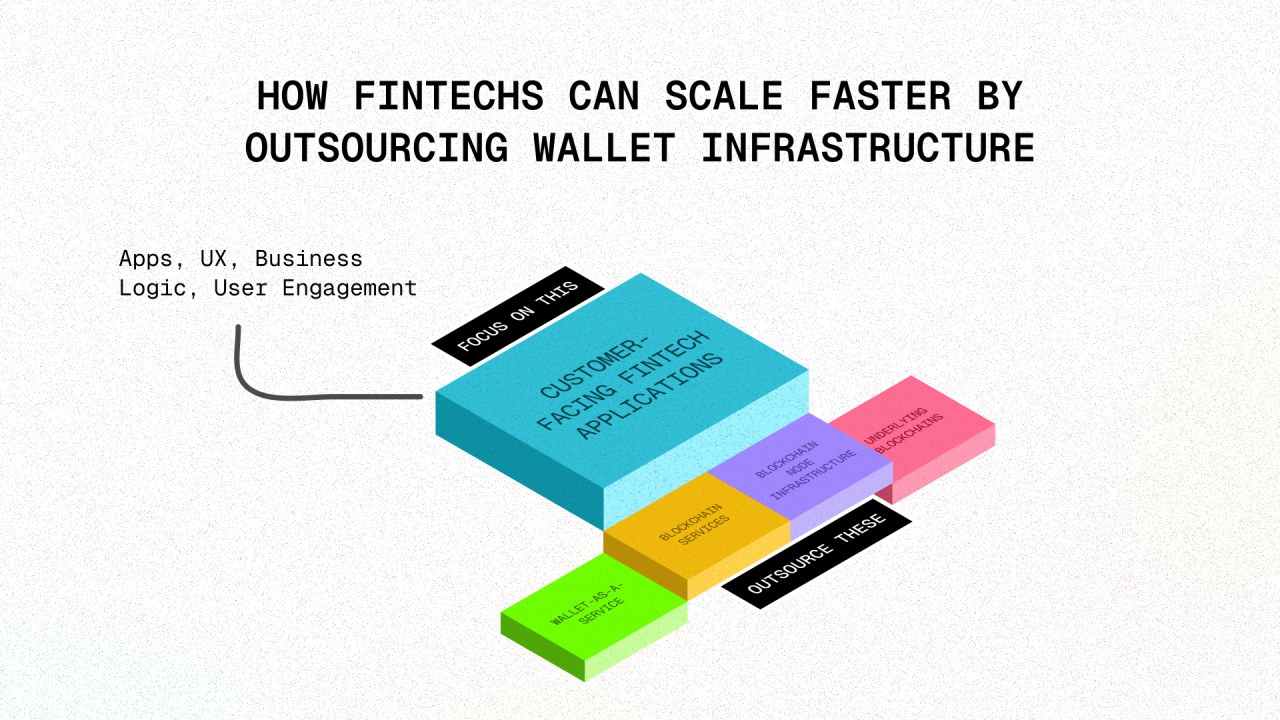

You don’t notice great infrastructure. That’s the point, it’s by design. Just like Stripe made payments invisible and Amazon Web Services (AWS) made servers disappear, the best wallet infrastructure should just work, securely, flexibly and across chains. But behind the scenes? Wallets are messy. Keys, chains, gas fees, monitoring, recovery logic, suddenly your roadmap is derailed and your team’s deep in blockchain plumbing.

For fintechs in emerging markets, stablecoins are more than a technical upgrade, they are a fundamental shift in how financial services are being delivered. Beyond eliminating inefficiencies, they empower businesses and individuals to operate in a truly borderless financial system, free from local banking constraints. This section highlights four critical pain points fintechs are solving with stablecoin-powered infrastructure. But first, let’s walk through a quick diagram of an example of what a stablecoin-powered user journey actually looks like.

Fintechs in emerging markets have unlocked financial access for millions, but cross-border payments remain costly, slow, and complex. Under the hood, fintechs still rely on traditional financial infrastructure, which struggles with FX volatility, high costs, and settlement delays—especially for small to mid-sized cross-border fintechs without economies of scale. Stablecoins are emerging as a game-changing tool, helping fintechs solve painful challenges faced by businesses and retail customers/users in emerging markets