If stablecoins are the future of money, wallet infrastructure is the new rail

You don’t notice great infrastructure. That’s the point, it’s by design.

Just like Stripe made payments invisible and Amazon Web Services (AWS) made servers disappear, the best wallet infrastructure should just work, securely, flexibly and across chains. But behind the scenes? Wallets are messy. Keys, chains, gas fees, monitoring, recovery logic, suddenly your roadmap is derailed and your team’s deep in blockchain plumbing.

From building in-person payments at Paystack to launching stablecoin rails at Lazerpay, I’ve learned that when infrastructure isn’t your core product, it’s almost always better to partner.

This post is a guide for founders and fintech teams: if you're thinking about building your own wallet infrastructure, here's what you're actually signing up for and why outsourcing it is the smart move companies keep making.

(Not familiar with the technical terms in the article? A quick glossary is included at the end.)

Infrastructure Is Always Outsourced - And for Good Reason

In finance and technology, companies rarely build mission-critical infrastructure themselves. Instead, they partner with specialized providers that deliver the scale, reliability, and security needed to operate globally.

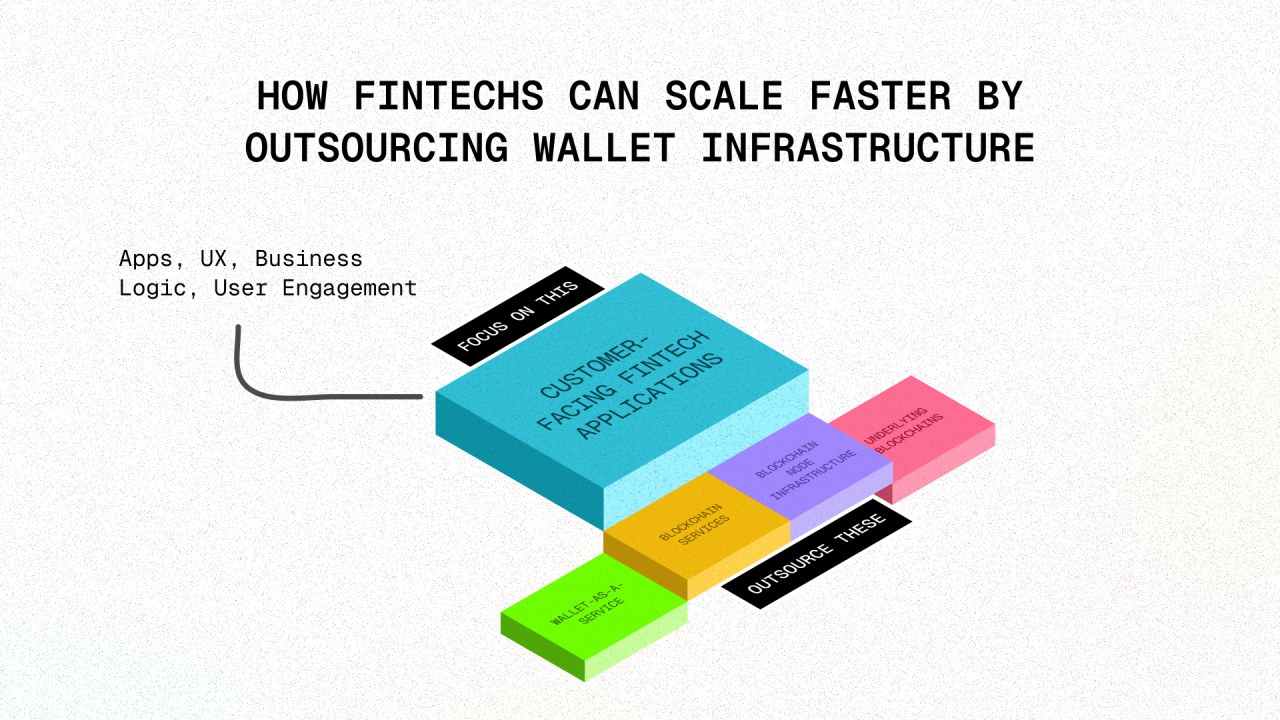

This model allows fintechs to move faster, reduce operational risk, and focus their energy where it matters most—on serving customers and building differentiated experiences. Rather than pouring time and capital into backend systems requiring 99.99% uptime and constant monitoring, they outsource the complexity and keep their teams focused on growth.

This timeline shows a clear pattern: every decade, a new layer of infrastructure gets abstracted away.

Companies use Stripe for payments,Amazon Web Services (AWS)f or computing, and Twilio for communications— outsourcing infrastructure to focus internal resources on creating exceptional products and experiences.

Today, blockchain represents the next frontier of infrastructure outsourcing. Node operation through Chainstack and Allnodes, key management via AWS KMS, and accessing blockchain data through indexing services like The Graph all follow this proven model. Stablecoins and wallet-as-a-service extend fintech capabilities with real-time cross-border settlement, programmable money flows, and reduced operational overhead.

The strategic question remains consistent: when to build vs when to outsource?

Blockchain wallet infrastructure brings 2 unique challenges that make it particularly difficult to build in-house:

1/ Security Challenges

Unlike traditional banking, where institutions control their own centralized ledgers, wallets involve private and public key pairs. The security challenge is that if a private key is exposed, funds can be drained instantly, with no recourse. There is no fraud department to call, no chargebacks—just irreversible transactions.

Many fintechs attempt to store private keys in their own infrastructure, sometimes encrypting them for added security. However, this still creates a single point of failure: if their database is compromised, an attacker could access the keys and move funds.

The best practice is to ensure private keys never exist (ie stored) in the system at all. Instead, advanced cryptographic techniques, like secure multiparty computation (MPC), hardware security modules (HSMs) and proprietary key vault management, ensure keys are generated and used without ever being exposed. This is the kind of security framework that requires deep cryptographic expertise—not something a fintech can casually implement.

2/ Blockchain Infrastructure Complexity

What looks like a simple SDK integration often hides a world of complexity. Building reliable blockchain infrastructure requires more than just connecting to chains. It demands deep understanding of decentralized networks and solutions to numerous engineering challenges:

- Multi-Chain Orchestration: Engineers must grasp each chain’s consensus, transaction formats, and node setup. Supporting Ethereum, Solana, Tron, and more requires deep cross-chain expertise.

- Real-Time Blockchain Monitoring: Infrastructure teams need systems that monitor live transactions, detect issues instantly, and recover smoothly—because blockchains keep running even when your infrastructure doesn’t.

- Autosweeping and Cost Optimization: Financial engineers must automate fund movement to cold wallets and avoid dust—otherwise, hidden costs add up fast.

- Asset Recovery: Effective infrastructure must handle cases where users send funds to incorrect addresses, common in multi-chain environments. Without proactive recovery mechanisms, funds can be permanently lost or require costly manual intervention.

- Transaction Integrity: Backend developers must ensure transactions are unique and double-spend-proof, critical for trust and accuracy.

And that’s just the beginning.These technical challenges and many more aren’t optional to solve for. They’re foundational requirements for delivering secure, scalable, and trustworthy blockchain products.

What It Really Takes to Build In-House

Building enterprise-grade wallet infrastructure requires significant investment. Between blockchain engineers, DevOps specialists, security experts, protocol researchers, compliance officers, and ongoing security updates, the total cost can range from $4-6 million in the first year alone.

This doesn't include long-term maintenance, multi-chain support, and constant security vigilance, which ultimately become a strategic distraction from most companies' core missions.

Stablecoin Wallet Infrastructure Is Here to Stay

As demand for stablecoins grows, the infrastructure supporting them will evolve rapidly. More fintechs and banks integrating stablecoins intensifies the need for scalable, secure, and compliant wallet infrastructure.

Just as payments moved from in-house solutions to platforms like Stripe, and computing shifted from private data centers to Amazon Web Services (AWS), stablecoin wallet infrastructure follows the same trajectory.

The expertise and cost required to build and maintain reliable, multi-chain wallets is prohibitive for most companies.

Even if your team solves the technical hurdles, the real weight shows up below the surface, costs that drain time, talent, and momentum:

Final Thought:

I believe the future of finance will be on the blockchain, with stablecoin wallets becoming essential components. Companies that leverage plug-and-play infrastructure will move faster, scale effectively, and deliver better financial experiences. The future runs on stablecoins. The only question is:who’s building the rails to support it?

Appendix: Quick Glossary for Non-Technical Readers

Stablecoins- Crypto assets pegged to fiat currencies like USD, Naira, EUR (e.g., USDC, USDT,cNGN, EURC), used for payments and cross-border transfers.

Wallet Infrastructure -Backend systems that manage crypto wallets—key security, blockchain access, and transaction processing.

Dust -Tiny amounts of crypto left in wallets that are too small to move due to high gas fees—often unspendable and a sign of inefficient fund management.

Private Keys -Secret codes that control wallet access. If lost or exposed, funds are unrecoverable.

MPC (Secure Multiparty Computation) -A method of splitting private key control across multiple parties so no one ever holds the full key.

HSM (Hardware Security Module) -A secure physical device used to protect and manage private keys.

Autosweeping -Automatically moving funds from hot wallets to central or cold wallets for better security and cost control.

Gas Fees -Network fees paid to process blockchain transactions—costs vary by chain and demand.

Multi-Chain Support -Ability to operate across multiple blockchains like Ethereum, Solana, and Tron.

Blockchain Node -A computer that stores a copy of a blockchain and helps verify and relay transactions on the network.

RPC Node (Remote Procedure Call Node) -A type of blockchain node that lets applications interact with the blockchain—used to send transactions, fetch data, or query smart contracts.

Indexing Services -Tools that organize blockchain data to make it easier to query and use in apps.

About Blockradar

Blockradar provides secure, developer-friendly stablecoin infrastructure for fintechs. Our non-custodial wallet APIs, transaction monitoring, and AML compliance tools make it easy to launch and scale stablecoin-powered financial services. From USDC and USDT payouts to onchain expense management, we help companies move money instantly and safely across borders—without building blockchain infrastructure in-house.

Blockradar is trusted by payment platforms, remittance providers, and Web3 startups building the future of finance.

Explore our API documentation and get started at https://blockradar.co