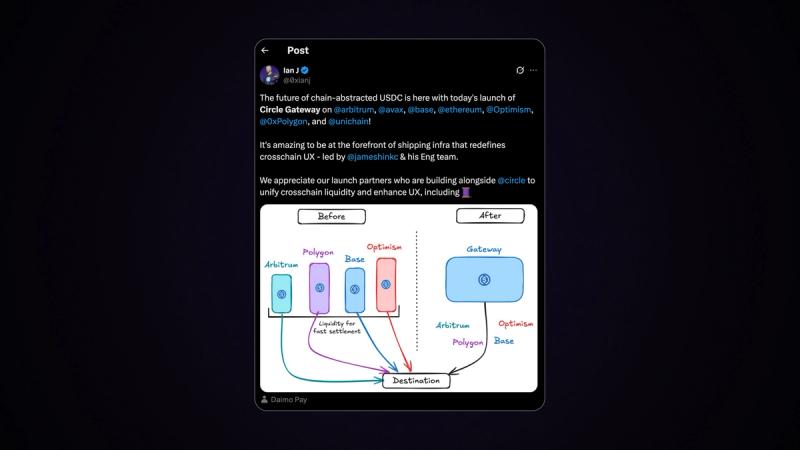

Yesterday, Circle announced that the Gateway has arrived on mainnet, a new product designed to solve one of the biggest headaches in stablecoin operations: wallet and chain fragmentation.

We’re proud that Blockradar is live as a Day 1 partner, integrating Gateway directly into our infrastructure.

What this means:

- For fintech operators: all deposits across chains consolidate into a single USDC balance, with auto-settlements it routes deposits automatically to the Gateway wallet. You no longer have to manually bridge or run into reconciliation fire drills.

- For end users: USDC deposits are instant and universal where chain drop-downs and wallet confusion start to disappear.

Circle Gateway is a step forward for the industry, and we’re excited to bring it to the fintechs we serve from Day 1.

V1: The Operator’s Perspective (Morgan)

Running ops in a fintech, you learn quickly that stablecoins solve some problems but can also create new ones. My biggest problem? Wallet reconciliation.

We allow our customers to pay on whatever chain they want. Great for them, but at the end of every month I’m left reconciling revenue across Ethereum, Base, Tron, BNB Chain, and more. What should be a simple line item becomes a tedious exercise in chain-by-chain detective work. Did that deposit land on Polygon? Or was it Base? I’ve lost time just tracking down what should have been obvious.

That’s why Circle Gateway matters. It takes all those fragmented inflows and consolidates them into a single USDC balance. They support Arbitrum, Avalanche, Base, Ethereum, Optimism, Polygon, and Unichain today, and expanding to future chains where USDC is native. Therefore, deposits can come from anywhere, but they show up in one place. When you need to withdraw, you choose the chain and move on. Clean, simple, and reliable.

And paired with our auto-settlement feature, it goes a step further. I can automatically send funds into the Gateway by setting rules that move them from the master wallets we use for customer collections, all programmatically. In other words, I don’t have to manually deposit into Gateway. Once the wallets hit a certain threshold, the balances are swept in automatically, saving me from yet another end-of-month headache.

Together, Gateway and auto-settlements turn a painful, manual reconciliation process into something close to invisible.

For our customers, and for operators like me who live this every day, the benefits are clear:

- One balance, not 10+ wallets

- Cleaner records for finance and audits

- Save on fees, no longer paying bridging fees

- Funds auto-routed from master wallets into one balance

- Time back to focus on growth and not reconciliation

V1 of our Gateway integration in Blockradar is built for teams like ours, fintechs that want cleaner treasury management and automation. If you’re managing high-volume cross-chain payments, it doesn’t just make life easier. It makes scaling possible.

V2: The User Experience Breakthrough (Clement)

As Morgan shared, V1 of our Gateway integration in Blockradar is about solving an operator’s headache. But the real breakthrough comes with what Gateway unlocks for end users.

Right now, most people really don’t want to think in terms of “Ethereum vs. Base vs. Solana.” They just want to pay, hold, and move money without worrying about chains, gas, or technical complexity. Yet that complexity is exactly what fintech builders have been forced to push onto their users.

V2 of our Gateway integration in Blockradar changes that. By abstracting the chain away, it lets users deposit from anywhere and still see the same seamless balance inside the app. For them, it feels like money just works. No need for chain selection and no wondering whether funds “landed” in the right place.

That shift matters for adoption. Every additional drop-down menu, every forced chain decision is a point of friction that loses the next billion users. When the blockchain disappears into the background, when the experience feels as natural as sending Venmo or MPesa, stablecoins stop being a niche tool and start being a mainstream financial rail.

For fintechs, the benefit is equally powerful. Gateway means you don’t have to re-architect for every new chain your customers demand. You can stay focused on delivering the right product experience, while the infrastructure takes care of the complexity underneath.

Imagine a world just a couple of years from now:

- Every major company or ecosystem has launched its own chain.

- There aren’t dozens of chains anymore, there are millions.

- For a user, that means every time they want to pay, save, or invest, they’re forced to make a confusing decision: Which chain do I select?

Here’s where Gateway + auto-settlements rewrite the script:

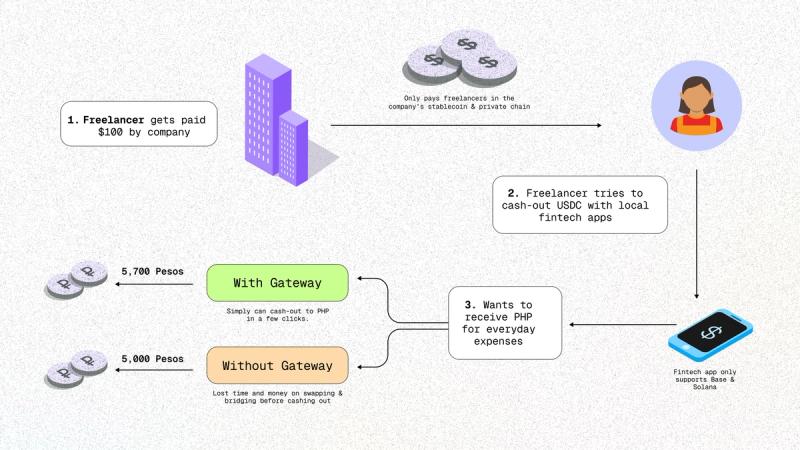

A freelancer in Manila gets paid by a U.S. company that insists on using its own private chain.

→ Normally, that’s a nightmare to use ubiquitously

Later, the freelancer wants to cash out in USDC from their company wallet into their local Filipino fintech app, which only supports Base and Solana.

→ Without Gateway, they’d need to figure out how to bridge their USDC, wasting time and losing money on gas fees.

With Gateway:

- They just deposit their USDC and their balance appears, no more chain drop-downs or manual swaps.

- They can easily withdraw USDC from their balance to their bank or anywhere else made possible by the unified USDC balance they now already have via Gateway.

With Gateway + auto-settlements:

- The end-user isn’t forced to deposit USDC, with auto-settlement, they can automatically deposit any stablecoin of their choice that’s then converted to USDC.

- The fintech itself doesn’t drown in end-of-month reconciliation across countless chains.

- All revenue is automatically routed into the Gateway.

For the freelancer, it feels like money just works. For fintechs, it’s one less ops fire drill. And at scale, this is how you make stablecoins usable by billions: by making the blockchain disappear.

Learn more: https://docs.blockradar.co/essentials/gateway

Get started: https://dashboard.blockradar.co/

See how the Gateway works with Blockradar:

About Blockradar

Blockradar provides secure, developer-friendly stablecoin infrastructure for fintechs. Our non-custodial wallet APIs, transaction monitoring, and AML compliance tools make it easy to launch and scale stablecoin-powered financial services. From USDC and USDT payouts to onchain expense management, we help companies move money instantly and safely across borders—without building blockchain infrastructure in-house.

Blockradar is trusted by payment platforms, remittance providers, and Web3 startups building the future of finance.

Explore our API documentation and get started at https://blockradar.co