Build trust into your app’s flow with AML screening baked-in

Once your app accepts stablecoin deposits, the next step is protecting your platform from risk. With Blockradar, every incoming deposit or withdrawal wallet address can be automatically screened for compliance using our built-in AML engine.

Here’s how to add that extra layer of protection in minutes.

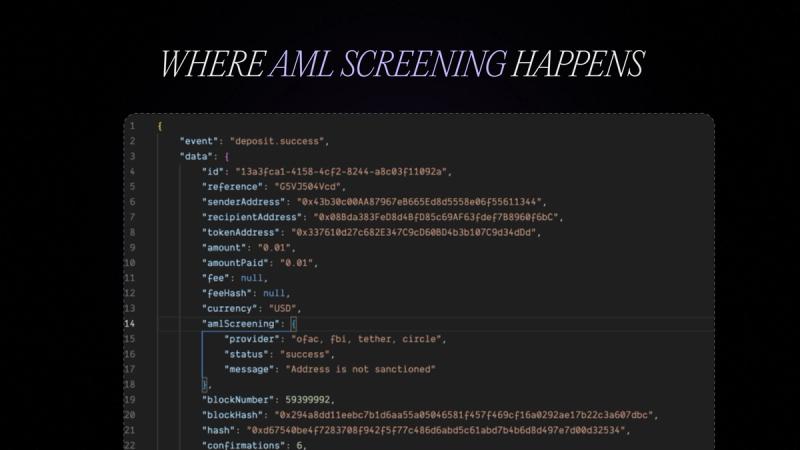

Step 1: Understand Where AML Screening Happens

AML checks are included in the deposit.success webhook event.

- Each transaction includes a flag called amlScreening.

- This flag will return a status of passed or failed.

Step 2: Act on Failed AML Flags Automatically

You can block payouts, pause user activity, or alert your compliance team—automatically.

Use the AML flag like this:

- If aml_screening.status = failed, pause user payout

- Trigger an admin alert

- Optionally log and investigate flagged wallet activity

Bonus: Blockradar sends email alerts for failed AML screens by default.

It's important to understand that Blockradar handles AML results differently depending on the type of action.

For deposit actions (i.e., when funds are sent to an address you generated via Blockradar), we notify you if the sender's address fails the AML check. However, since the transaction is already on-chain, we cannot block it — we simply surface the AML result for your awareness.

For withdrawal actions (i.e., when your users attempt to send funds to an address), if the destination address is flagged as sanctioned or fraudulent, we block the withdrawal and notify you via email.

Every AML check on Blockradar is multi-level. We don’t just check the address you’re receiving from; we also trace the addresses it has interacted with, multiple levels deep. This means that even if the sending address itself isn’t sanctioned, but it has previously received tokens from a sanctioned address, we’ll still flag or block the transaction depending on the action type.

Step 3: Maintain Transparency for Admins

Even if your system auto-handles failed AML flags, your operations team gets visibility too.

- AML failures are shown on the dashboard

- You can view source wallet info and details of the risk profile

This lets you handle compliance issues confidently, without slowing down growth.

Build compliance without code debt

With Blockradar, you don’t need a separate AML vendor or manual review flow to protect your app. It’s built-in from day one.

Stay tuned for our next article on as we detail how to use swap & bridge.

About Blockradar

Blockradar provides secure, developer-friendly stablecoin infrastructure for fintechs. Our non-custodial wallet APIs, transaction monitoring, and AML compliance tools make it easy to launch and scale stablecoin-powered financial services. From USDC and USDT payouts to onchain expense management, we help companies move money instantly and safely across borders—without building blockchain infrastructure in-house.

Blockradar is trusted by payment platforms, remittance providers, and Web3 startups building the future of finance.

Explore our API documentation and get started at https://blockradar.co