Stablecoins have always made sense to those of us building in the payments space. They’re faster than banks, cheaper than remittance rails, and easier to integrate than most people realize. But until recently, regulatory uncertainty kept them stuck in the “too risky” pile for many institutions.

That’s changing. Fast.

This year, the U.S. gave us two major signals: the GENIUS Act, which creates a federal framework for dollar-backed stablecoins, and the SEC’s Project Crypto, which recognizes the role of self-custody wallets in the future of finance. Together, they’re sending a clear message: stablecoins aren’t fringe anymore. They’re becoming part of the financial system’s core infrastructure.

For fintechs across Africa, Latin America, and Southeast Asia, this isn’t just a U.S. headline. It’s a shift that legitimizes what many of us have already been building. And it could finally unlock broader adoption, partnerships, and compliance-ready integrations at scale.

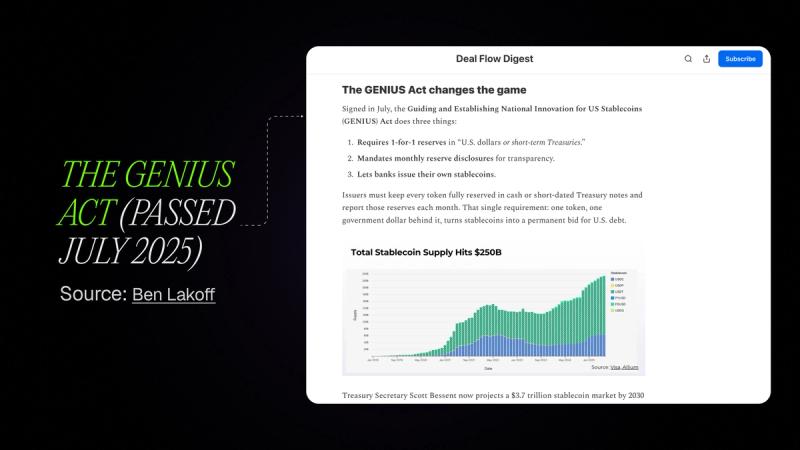

The GENIUS Act: A Clear Signal for Adoption

The GENIUS Act, passed in July 2025, is the first time the U.S. has laid out national rules for fully reserved, dollar-backed stablecoins. It mandates transparency, regular audits, and 1:1 backing. As Ben Lakoff put it, “The GENIUS Act is a major step forward for the U.S. dollar as a programmable, global payment instrument” (Source).

This matters, even outside the U.S. Because in countries like Nigeria, Mexico, Brazil, and the Philippines, stablecoins are already in use: as a hedge against inflation, as a faster way to move money across borders, and as a workaround for banking limits. What’s been missing is regulatory clarity. And now that the U.S. is showing its cards, other regulators have a model to respond to or align with.

We’re already seeing early moves. In the Philippines, Coins.ph’s PHPC, a peso-pegged stablecoin, recently graduated from the central bank’s sandbox and is now powering real remittance flows. In Singapore (a leader in “regulated innovation”), StraitsX has issued XSGD and XIDR stablecoins tied to the Singapore dollar and Indonesian rupiah, with growing adoption across Southeast Asia (Source).

This really isn’t talk anymore. It's a positive regulatory movement and smart fintechs are adapting.

Legacy Giants Are Moving Too

If you’re still wondering whether stablecoins are ready for prime time, look at Western Union. The remittance giant just announced it will start using stablecoins and AI to improve settlement speed, cost, and access in underserved markets.

I don’t think this is just another pilot, I believe it’s a signal. When companies like Western Union, Visa, and Stripe are integrating stablecoin rails, it means we’ve left the speculative phase. This is infrastructure now.

For fintechs, especially those operating across fragmented FX corridors or dealing with slow settlement, the takeaway is simple: building with stablecoins is no longer a regulatory gamble and rather see it as an operational advantage.

Self-Custody: The Shift

There’s another important shift happening in parallel is self-custody wallets are being normalized.

What used to be a technical choice for some of us crypto power users is now being recognized as a pillar of modern financial infrastructure. Even the SEC is acknowledging this. Commissioner Paul Atkins recently stated, “The right to have self-custody of one’s private property is a core American value” (Source).

That matters for the markets we serve. In high-risk or underbanked environments, self-custody becomes a necessity. When users can hold stablecoins directly, without relying on fragile banks or intermediaries, the system becomes more resilient, more accessible, and more aligned with how people actually move money.

For financial services, self-custody is a product advantage. You don’t need a custodial license. You don’t need to hold user funds. And instead you get more modularity, faster time to market, and cleaner separation of concerns. You can ship programmable wallets with built-in spending rules, gas sponsorship, or auto-routing logic without depending on a bank or centralized exchange.

If you're a fintech building in emerging markets, where trust and access aren’t guaranteed, supporting self-custody shouldn’t be a future roadmap item. I believe it’s table stakes and allows you to meet your customers where they are.

The Rails Are Ready. Now What?

If you’re a fintech founder, operator, or investor looking at this moment, understand this is an opportunity. The GENIUS Act gives the industry a compliance framework. Western Union and others are proving the commercial case. Self-custody is earning regulatory backing. And in the global south, the use cases are very real and very urgent.

We’ve been talking about the “future” of finance for a while. But for those of us working at the edge of remittances, cross-border B2B payments, and USD access in hard places, we know it’s always been about infrastructure. And we also know the future is actually here now.

The rails are ready and the world is watching. If you’ve been building and serving billions of users on legacy rails, the signal is clear: now is the time to move.

About Blockradar

Blockradar provides secure, developer-friendly stablecoin infrastructure for fintechs. Our non-custodial wallet APIs, transaction monitoring, and AML compliance tools make it easy to launch and scale stablecoin-powered financial services. From USDC and USDT payouts to onchain expense management, we help companies move money instantly and safely across borders—without building blockchain infrastructure in-house.

Blockradar is trusted by payment platforms, remittance providers, and Web3 startups building the future of finance.

Explore our API documentation and get started at https://blockradar.co